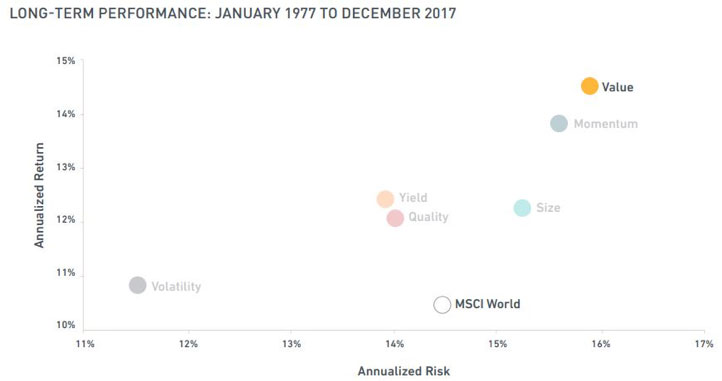

A factor is any characteristic that helps explain the long-term risk and return of an asset class. Factors are well documented in academic research and have been used extensively in portfolio risk models and quantitative investment strategies. These are the same variables that active fund managers use in their security selection and portfolio construction process.

Factor investing is not new. It has long been used in quantitative investment strategies. Factor investing seeks to capture higher risk-adjusted returns via systematic exposure to equity characteristics. Over the years, both the academic world and the investment industry have identified six individual factors that have historically delivered out-performance relative to the broad stock market.

These six factors are:

Value – Investing in relatively inexpensive stocks

Momentum – Investing in stocks with positive price movement

Quality – Investing in quality companies with sound balance sheets

Smaller Size Companies – Investing in small and mid-sized companies

Dividend Yield – Investing in companies with above average cash flow payout

Low Volatility Stocks – Investing in lower beta stocks

Below is detailed information on these six factors. In constructing individual portfolios for clients, we strive to capture at least three of these factors.

CLICK BELOW TO LEARN MORE ABOUT THE FACTORS:

Below is a list of Factor Model Portfolios available on the platform:

Equity

- DFA Global 100

- DFA Global 100 ST

- DFA U.S. 100

- VMQ (Value, Momentum, & Quality)

- Quality Equity Income

- MV Equity Income

Fixed Income

- U.S. Fixed Income

- U.S. Enhanced Fixed Income

In addition to these models, all models offered by FPL Capital Management can be utilized on the platform.